Car Insurance Overview

The Basics:

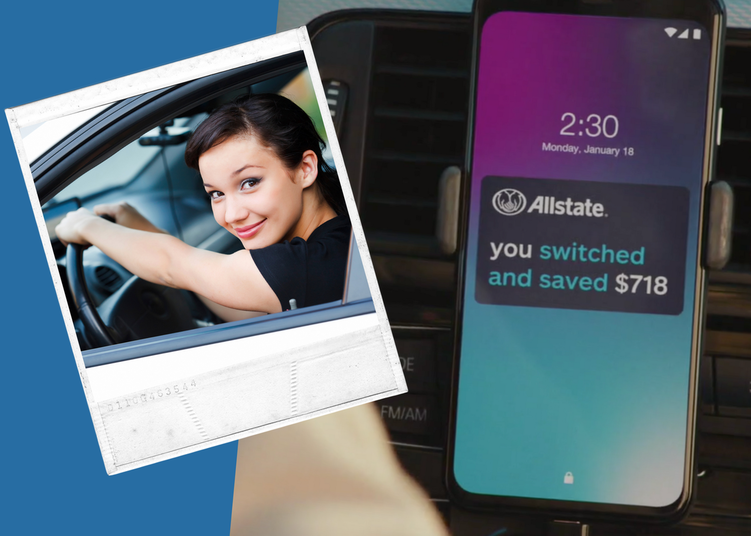

Auto insurance is used to provide financial protection against physical damage or bodily harm as a result of traffic collisions and against liability (responsibility) that could arise from incidents that happen while in a vehicle. When you buy insurance, you’re essentially buying different types of coverage plans that an insurer (the company you purchase the insurance from) agrees to pay for. Based on the coverage plan you select, different items will be covered in the event of an accident on injury while in a vehicle. Usually the more expensive the coverage the more things that are covered. A brand new car, for instance may require that you purchase “Full-coverage” for your car. Full coverage covers the car, you, the passengers, and being hit by uninsured motorists (people without insurance) up to a certain amount. Be aware that no insurance covers you in all situations, but “full-coverage” protects you in the maximum amount of scenarios possible.

If you don’t quite need “full-coverage” rest assured there are different coverage packages that can cover the specific scenarios that we believe may be the best to fit your needs. Whether it be if you’re looking for coverage to protect your vehicle, collision coverage, repair costs, optional coverage like new car replacement coverage or loan/lease game coverage, we are more than happy to discuss and educate you, so that you walk away knowing exactly what you’re getting.

We are committed to our clients and are chosen time and time again as we have helped serve the needs of the auto insurance Denver market and its surrounding areas. Whether you are completely new to this and searched “cheap auto insurance in Denver” or are coming to us already educated, we want to prioritize your needs and help you walk away with the best insurance coverage possible.

Auto insurance is used to provide financial protection against physical damage or bodily harm as a result of traffic collisions and against liability (responsibility) that could arise from incidents that happen while in a vehicle. When you buy insurance, you’re essentially buying different types of coverage plans that an insurer (the company you purchase the insurance from) agrees to pay for. Based on the coverage plan you select, different items will be covered in the event of an accident on injury while in a vehicle. Usually the more expensive the coverage the more things that are covered. A brand new car, for instance may require that you purchase “Full-coverage” for your car. Full coverage covers the car, you, the passengers, and being hit by uninsured motorists (people without insurance) up to a certain amount. Be aware that no insurance covers you in all situations, but “full-coverage” protects you in the maximum amount of scenarios possible.

If you don’t quite need “full-coverage” rest assured there are different coverage packages that can cover the specific scenarios that we believe may be the best to fit your needs. Whether it be if you’re looking for coverage to protect your vehicle, collision coverage, repair costs, optional coverage like new car replacement coverage or loan/lease game coverage, we are more than happy to discuss and educate you, so that you walk away knowing exactly what you’re getting.

We are committed to our clients and are chosen time and time again as we have helped serve the needs of the auto insurance Denver market and its surrounding areas. Whether you are completely new to this and searched “cheap auto insurance in Denver” or are coming to us already educated, we want to prioritize your needs and help you walk away with the best insurance coverage possible.

Location and Office Hours

Monday: 9am - 7pm

Tuesday: 9am - 7pm

Wednesday: 9am - 7pm

Thursday: 9am - 7pm

Friday: 9am - 7pm

Saturday: 9am - 5pm

Sunday: Closed

Tuesday: 9am - 7pm

Wednesday: 9am - 7pm

Thursday: 9am - 7pm

Friday: 9am - 7pm

Saturday: 9am - 5pm

Sunday: Closed